Research

Published Papers

High Discounts and Low Fundamental Surplus: An Equivalence Result for Unemployment Fluctuations

with Indrajit Mitra and Yu Xu

Management Science, 2024, Volume 70 Issue 6

Link to paper, SSRN version, Internet appendix

We establish an observational equivalence between unemployment fluctuations of the Diamond-Mortensen-Pissarides search economy augmented with time-varying risk premia, and an otherwise identical economy without risk-premia but with a time-varying value of leisure. This equivalence holds for general risk-premia processes and allows us to view the effects of different models of risk-premia as operating through a single channel—one that alters the value of leisure. We derive simple expressions for semi-elasticities of labor market tightness with respect to productivity and risk premium shocks. We show wages can be used to detect misspecification in the discount rate process used in hiring decisions.

Working Papers

Ambiguity and Unemployment Fluctuations

with Indrajit Mitra and Yu Xu

Link to paper, SSRN version, GitHub repository

We analyze the consequences of ambiguity aversion in the Diamond-Mortensen-Pissarides (DMP) search and matching model. Our model features a cross-section of workers whose productivity contains a match-specific component. Firms are ambiguity averse towards match-specific productivity. Our model delivers two insights. First, we show that ambiguity aversion substantially amplifies unemployment rate volatility. Second, we show that a part of the high value of leisure required by the canonical DMP model to generate realistic unemployment rate volatility can arise from fitting a model missing ambiguity aversion to data generated in an environment where agents are ambiguity averse.

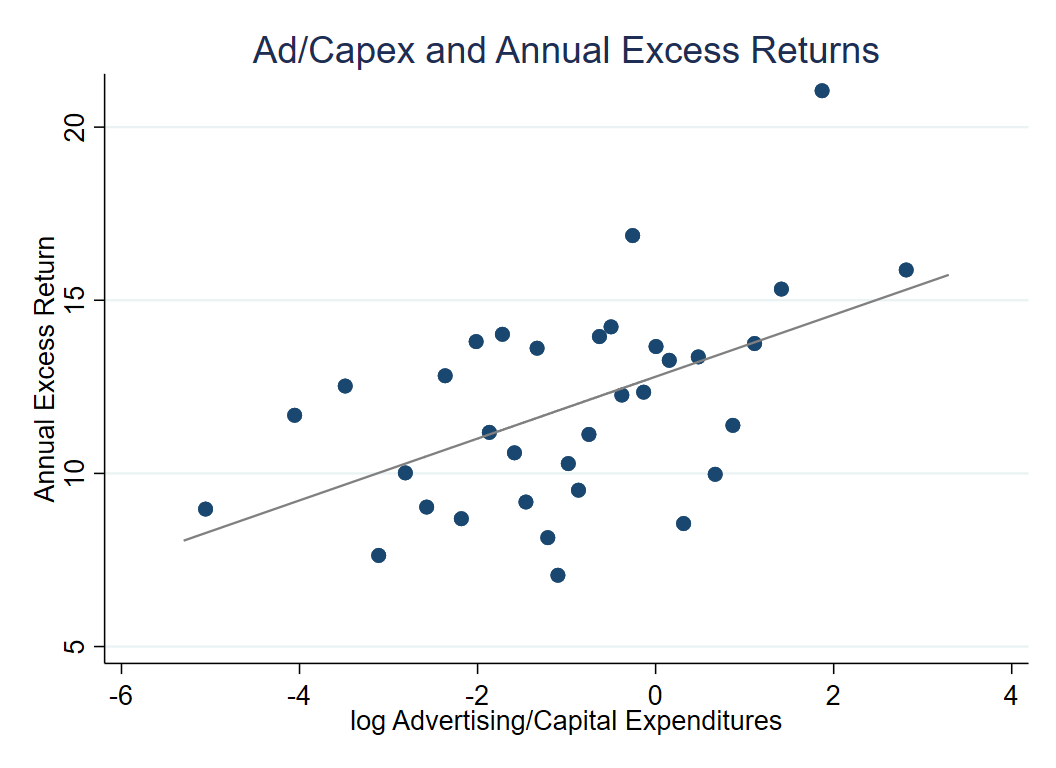

Two Persistent Trees: Advertising and the Cross Section of Equity Returns

How does a firm’s advertising policy affect its risk, and its expected return? I propose that the relative size of advertising to capital expenditures is a key statistic that summarizes firms’ exposures to their investment opportunities. I find firms that invest more in advertising earn about 4.39% more risk-adjusted returns per year compared to their capital expenditure-intensive counterparts. I then provide a theoretical explanation with a production-based asset pricing model where advertising and physical capital differ in their reversibility. When the model is simulated using parameters consistent with firms’ advertising and capital expenditures, it is able to explain 23% of the portfolio return.

Deposit Market Competition and Equity Capital Issuance

with Yunhan Shin and Jangsu Yoon

Link to paper, SSRN version

This article investigates the relationship between equity capital and deposits in the U.S. banking industry. We find empirical evidence that the cost of deposits is a significant factor in a bank’s equity capital issuance since higher deposit costs increase the bank’s insolvency risk. Our analysis highlights that a bank with a well-diversified deposit base may face higher insolvency risk, especially when deposit costs are sufficiently high. We propose a structural model of deposit markets to incorporate our findings and illustrate how deposit competition affects banks’ deposit costs and equity capital issuance. The counterfactuals imply that higher capital requirements may increase the likelihood of default for larger and more diversified banks, as the policy makes the local deposit market more competitive and raises deposit costs. Additional regulations, such as caps on deposit rates, may mitigate this effect while making equity issuance more frequent.

Non-Peer Reviewed Publications

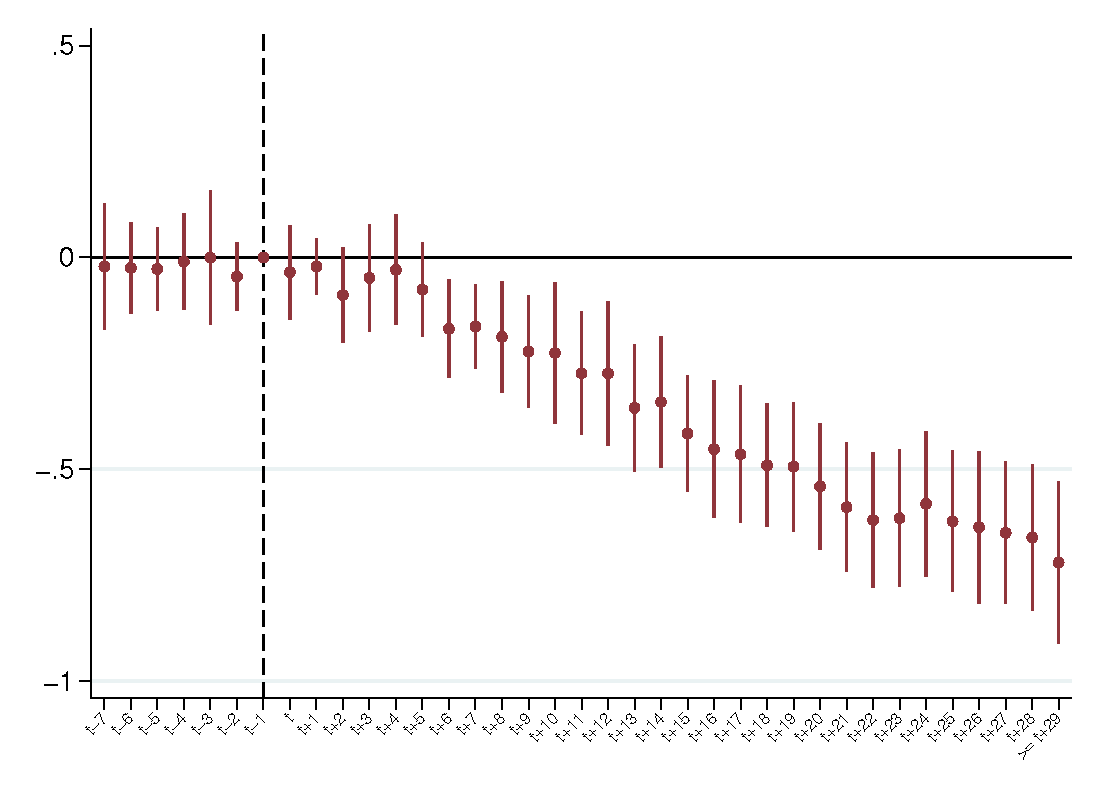

COVID-19 and Stay-At-Home Orders: Identifying Event Study Designs with Imperfect Testing

with Jaedo Choi, Elird Haxhiu, Thomas Helgerman and Nishaad Rao

Covid Economics, 2021, Issue 76

Link to paper, CEPR version

This paper estimates the dynamic effect of Stay-At-Home (SAH) orders on the transmission of COVID-19 in the United States. Identification in this setting is challenging due to differences between real and reported case data given the imperfect testing environment, as well as the clearly non-random adoption of treatment. We extend a Susceptible-Infected-Recovered (SIR) model from Epidemiology to account for endogenous testing at the county level, and exploit this additional structure to recover identification. With the inclusion of model-derived sufficient statistics and fixed effects, SAH orders have a large and sustained negative effect on the growth of cases under plausible assumptions about the progression of testing. Point estimates range from a 44% to 54% reduction in the growth rate of cases one month after a SAH order. We conclude with a discussion on extending the methodology to later phases of the pandemic.